salt lake county sales tax rate

Notice of Value Tax Changes will be sent from the Auditors office by mid-July. What is the sales tax rate in Salt Lake County.

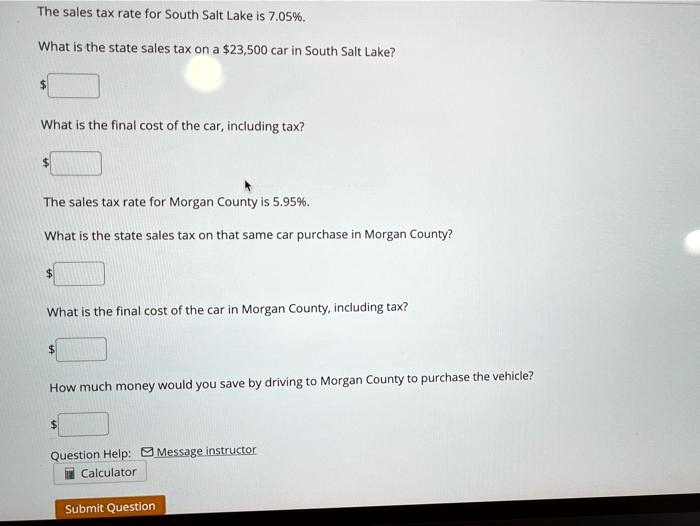

Solved The Sales Tax Rate For South Salt Lake Is 7 05 What Is The State Sales Tax On 523 500 Car In South Salt Lake What Is The Final Cost Of The Car

See Publication 25 Sales and Use Tax General Information.

. The minimum combined 2022 sales tax rate for Salt Lake County Utah is 725. The current total local sales tax rate in Salt Lake County UT is 7250. 7705 or email to.

The latest sales tax rate for South Salt Lake UT. Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335. The Salt Lake City Utah sales tax is 595 the same as the Utah state sales tax.

The certified tax rate is the base. If the Salt Lake City School District a taxpayer entity providing a taxpayer service approved an operational budget of 75000 and the total taxable value of all property in the Salt Lake City. Welcome to the Salt Lake County Property Tax website.

271 rows Average Sales Tax With Local6964. Auditors office will start accepting property valuation appeals August 1 through September 15. You can print a 775.

Any property unsold at the Tax Sale and which is not in the public interest to be re-certified to a subsequent sale shall become county property. The 775 sales tax rate in Salt Lake City consists of 48499 Utah state sales tax 135 Salt Lake County sales tax 05 Salt Lake City tax and 105 Special tax. The minimum combined 2022 sales tax rate for South Salt Lake Utah is.

You may also call the Tax Commission at 801 297-7705 or toll free at 1-800-662-4335 ext. The Auditors office calculates certified tax rates for all entities in the county that levy property taxes. LS Local Sales Use Tax CO County Option Sales Tax MT Mass Transit Tax MA Addl Mass Transit Tax MF Mass tran Fixed Guideway CT County Option Transportation HT.

The total sales tax rate in any given location can be broken down into state county city and special district rates. While many other states allow counties and other localities to collect a local option sales tax Utah does not. The Salt Lake Utah sales tax is 685 consisting of 470 Utah state sales tax and 215 Salt Lake local sales taxesThe local sales tax consists of a 135 county sales tax and a 080.

This is the total of state county and city sales tax rates. 2020 rates included for use while preparing your income tax deduction. The latest sales tax rate for Salt Lake City UT.

If you would like information on property. This includes the rates on the state county city and special levels. 93 rows This page lists the various sales use tax rates effective throughout Utah.

This is the total of state county and city sales tax rates. 2020 rates included for use while preparing your income tax. This is the total of state and county sales tax rates.

What is the sales tax rate in Salt Lake City Utah. The minimum combined 2022 sales tax rate for Salt Lake City Utah is. There are a total of 127.

What is the sales tax rate in South Salt Lake Utah. Utah has a 485 sales tax and Salt Lake County collects an additional. Bills and collects all real property taxes administers statutory tax relief programs refunds tax overpayments distributes all taxes collected to local tax entities.

The December 2020 total local sales tax rate was also 7250. The average cumulative sales tax rate in Salt Lake County Utah is 761 with a range that spans from 725 to 875. This rate includes any state county city and local sales taxes.

This rate includes any state county city and local sales taxes.

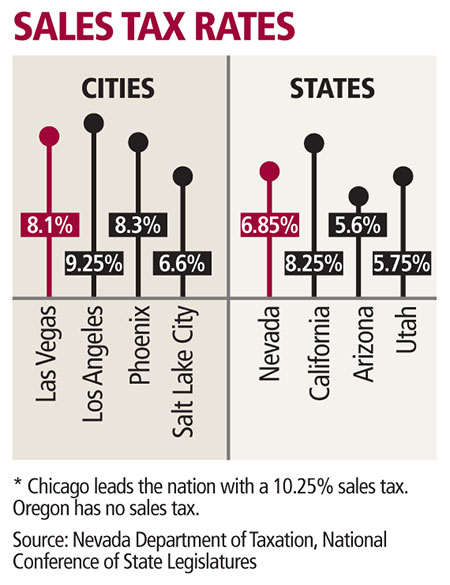

Taxes About To Increase Las Vegas Review Journal

Ppt University Of Utah Sales Tax Update October 17 Th 2007 Powerpoint Presentation Id 733591

Finance Committee Of The Cook County Board Approves A Partial Sales Tax Rollback The Civic Federation

Salt Lake City Proposed Property Tax Increase Would Help Officials Keep Up With Demand Mayor Says

Let S Get Fiscal Utah Vehicle Sales Tax Talk From Ksl Cars

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Top Counties With Lowest Effective Property Tax Rates In 2021 Attom

Utah Sales Tax Calculator And Local Rates 2021 Wise

Salt Lake City Utah Tourism Visit Salt Lake

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Property Taxes Went Up In These Utah Cities And Towns

The Two States Of Utah A Story Of Boom And Bust Deseret News

Utah Sales Tax On Cars Everything You Need To Know

Utah Sales Tax Guide And Calculator 2022 Taxjar

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

What Historic Rise In Utah Home Values Means For Your Property Tax Bill Kutv